BP FDMS CAT Charge Details: What to Do If You See It

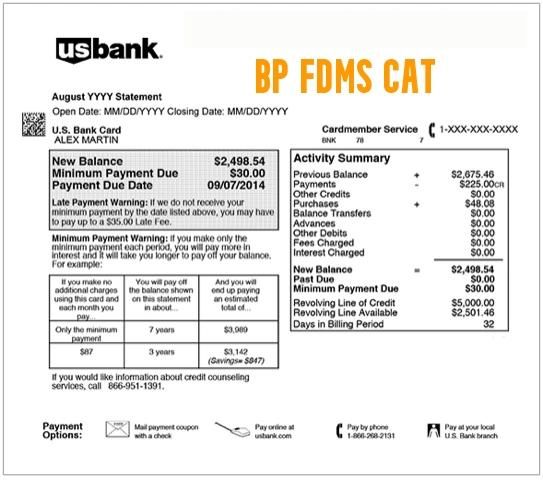

The term BP FDMS CAT may appear on your credit card statement, causing confusion and concern. This charge, often linked to fuel purchases at BP gas stations, is a pre-authorization hold or a temporary reservation of funds by your bank. It is essential to understand what this charge means, why it occurs, and how you can manage or dispute it if necessary. In this article, we will dive deep into the concept of BP FDMS CAT, covering all aspects to help you understand it better.

What is BP FDMS CAT?

BP FDMS CAT stands for British Petroleum Fuel Dispenser Management System Category. It appears on your bank statement when you use a credit or debit card at a BP gas station. This charge is typically a pre-authorization hold, ensuring that you have enough funds in your account to cover the fuel purchase. It is not a fraudulent charge, but a legitimate process to secure the transaction amount.

Why Does BP FDMS CAT Appear on Your Statement?

The BP FDMS CAT charge appears because gas stations, especially those with self-service options, need to verify that your card can cover the cost of fuel before you pump it. This charge can vary, often ranging from $50 to $150, depending on the station and your bank’s policies. The actual amount is released once the final transaction is completed, reflecting the exact amount spent on fuel.

Common Scenarios of BP FDMS CAT Charges

1. Pre-Authorization Holds

When you swipe your card at the pump, a pre-authorization hold is placed to confirm that you have sufficient funds. This hold amount is higher than the expected purchase to cover any potential fuel amount.

2. Pending Transactions

If you notice a pending BP FDMS CAT charge, it means that the bank is holding a certain amount temporarily. This charge will disappear and be replaced by the actual amount spent within a few days.

3. Multiple Charges

Sometimes, the pre-authorization hold remains even after the actual charge posts. This situation usually resolves itself, but it can temporarily reduce your available credit.

How to Manage BP FDMS CAT Charges

1. Check Your Statement Regularly

Regularly reviewing your bank statement helps you spot any unexpected charges. If you see charge, cross-reference it with your recent fuel purchases to ensure accuracy.

2. Understand Pre-Authorization Holds

Knowing that these charges are temporary can prevent unnecessary panic. They typically get adjusted within a few days, reflecting the actual fuel cost.

3. Contact Your Bank

If the hold doesn’t disappear or the amount seems incorrect, contact your bank for clarification. They can provide details and help resolve any discrepancies.

How to Dispute BP FDMS CAT Charges

If you believe the charge on your statement is incorrect or fraudulent, follow these steps to dispute it:

- Verify the Charge: Check your purchase history to confirm whether you made a recent fuel purchase at a BP gas station.

- Contact the Merchant: Reach out to the BP station where the transaction occurred. They may clarify the charge or confirm if an error was made.

- Report to Your Bank: If you can’t resolve the issue with the merchant, contact your bank or credit card issuer. Explain the situation and request an investigation into the charge.

- Submit a Dispute: Your bank may require you to submit a formal dispute. Follow their instructions and provide any necessary documentation.

Post You Might Like: 50 beale street san francisco charge on credit card

Why Does BP FDMS CAT Charge Vary?

The amount held as BP FDMS CAT can vary for several reasons:

- Station Policies: Different BP gas stations have different hold policies, which can affect the amount reserved.

- Bank Policies: Your bank may have specific rules regarding pre-authorization holds for fuel purchases.

- Transaction Method: Using a credit card, debit card, or entering your PIN can impact the hold amount.

Tips to Avoid BP FDMS CAT Issues

- Use a Credit Card: Credit cards often handle pre-authorization holds more smoothly than debit cards, reducing the chance of overdraft fees.

- Pay Inside: Paying directly inside the gas station instead of at the pump can prevent pre-authorization holds.

- Monitor Your Account: Keep an eye on your bank account to ensure that pre-authorization holds are released in a timely manner.

BP FDMS CAT and Fraud Prevention

While the BP FDMS CAT charge is usually legitimate, it is essential to remain vigilant against potential fraud. Here are some steps to protect yourself:

- Secure Your Card Information: Always keep your card details private and avoid using unfamiliar or suspicious pumps.

- Monitor Your Statements: Regularly check your bank statements for any unfamiliar charges.

- Report Suspicious Activity: If you suspect fraud, report it to your bank immediately and take necessary precautions, such as canceling your card.

BP FDMS CAT in Different Situations

1. Traveling

When traveling, it’s common to see higher pre-authorization holds at gas stations due to increased fuel costs or unfamiliar locations. Understanding this can prevent confusion when you notice larger holds.

2. Using Different Cards

Different cards may handle BP FDMS CAT holds differently. For example, some cards may not show the hold at all, while others will list it as a pending transaction.

The Importance of Understanding BP FDMS CAT

Understanding BP FDMS CAT charges is essential for “effective financial management“. These charges are common for fuel purchases and are usually temporary. By knowing how they work, you can avoid confusion, manage your funds better, and know when to take action if something seems wrong.

| Aspect | Description | Benefit |

|---|---|---|

| Pre-Authorization Holds | BP FDMS CAT represents a temporary hold to ensure funds availability before completing the purchase. | Helps understand why initial amounts may be higher than final charges. |

| Transaction Verification | It is used to verify if the card can cover potential fuel costs, preventing fraudulent or incomplete transactions. | Ensures transaction security and avoids misuse of funds. |

| Dispute Management | Understanding the nature of BP FDMS CAT helps in efficiently managing and disputing unexpected charges. | Prevents confusion and allows quick resolution of genuine issues. |

| Financial Planning | Knowing how pre-authorization holds work aids in better managing available credit and bank balances. | Avoids surprises in available balance and prevents overdrafts. |

| Fraud Prevention Awareness | Awareness of legitimate holds reduces panic over potential fraudulent charges. | Helps differentiate between real fraud and normal pre-authorizations. |

| Better Communication with Bank | Being informed about BP FDMS CAT allows clearer communication with bank representatives if issues arise. | Facilitates faster issue resolution and account management. |

Common Misconceptions About BP FDMS CAT Charges

Many consumers encounter this charges on their credit or debit card statements and assume the worst, believing it to be a fraudulent charge or a scam. However, these misconceptions stem from a lack of understanding of the transaction process, particularly how pre-authorization holds work at gas stations.

1. It’s Not a Fraudulent Charge

A common misconception is that BP FDMS CAT represents a fraudulent charge. This confusion arises because the amount on the statement may not immediately match the final purchase, as it often shows as a larger pending amount. However, it’s a legitimate hold that gas stations place to ensure your account has enough funds to cover the purchase.

2. It’s Not a Final Charge

Many believe the amount shown under BP FDMS CAT is the final charge, leading to concerns when the pending amount is much higher than expected. In reality, this is just a temporary hold that will be adjusted once the actual purchase amount is processed.

3. The Hold Is Temporary

Another misconception is that the charge will remain on the account permanently if not disputed. In most cases, these pre-authorization holds last between 1 to 3 days and disappear once the transaction is fully processed. If the hold remains longer, it’s best to contact your bank to clarify the situation.

How Long Do BP FDMS CAT Charges Last?

BP FDMS CAT charges, typically pre-authorization holds, usually last between 1 to 3 business days. However, this duration can vary based on several factors, including the policies of your bank and the gas station.

Factors Influencing the Duration of BP FDMS CAT Charges:

- Bank Policies: Different banks have varying policies regarding the duration of pre-authorization holds. While most banks release the hold within a few days, some may take longer.

- Gas Station Practices: The amount and duration of the hold can also depend on the gas station’s policies. Some stations may place holds for longer periods, especially if the transaction involves larger amounts.

- Transaction Method: The method used to complete the transaction, such as credit or debit, can affect how long the hold remains on your account. Debit card holds may last longer compared to credit card holds.

- Resolution Time: If the charge doesn’t clear within the usual timeframe, it may be due to an error in processing or communication between the bank and the gas station. In such cases, contacting your bank can help expedite the release of the hold.

People Also Read: Int’l Digital: A Guide to International Digital Transactions

What to Do If BP FDMS CAT Charges Don’t Clear

If the charges on your statement don’t clear within the usual timeframe (typically 1-3 business days), follow these steps:

- Check Recent Transactions:

- Review your bank statement to verify if the hold corresponds to a recent purchase at a BP gas station. Make sure the final transaction amount has posted.

- Contact Your Bank:

- Reach out to your bank’s customer service to report the issue. Provide details like the transaction date, the amount of the hold, and any relevant receipts. They can help investigate and release the hold.

- Contact the Gas Station:

- If the bank is unable to resolve the issue, contact the BP station where the charge originated. They might be able to confirm whether the hold is still active and expedite the release.

- Submit a Dispute:

- If you believe the charge is incorrect or was never authorized, file a formal dispute with your bank. They may require you to submit documentation to support your claim.

- Monitor Your Account:

- Keep an eye on your account for any changes. The hold should be released, and your available balance restored within a few days.

By taking these steps, you can ensure that any discrepancies are addressed promptly and that your account reflects the correct transaction amount.

Conclusion

In conclusion, BP FDMS CAT is a standard pre-authorization charge that appears on your credit or debit card statement when you purchase fuel at BP gas stations. It ensures that sufficient funds are available before you pump gas. Although it can be confusing, it is not a fraudulent charge and typically resolves itself within a few days. Understanding this process helps you manage your finances more effectively and avoid unnecessary concerns. If you encounter issues or discrepancies, don’t hesitate to contact your bank for assistance.

Read To Know About: Fid Bkg Svc llc Moneyline

Frequently Asked Questions (FAQs)

What is BP FDMS CAT on my bank statement?

- It is a pre-authorization hold placed by BP gas stations to confirm sufficient funds for fuel purchases before allowing you to pump.

Why does BP FDMS CAT appear as a pending charge?

- It appears as a pending charge to temporarily reserve funds. The amount is adjusted to the actual purchase after the transaction is completed.

Is BP FDMS CAT a fraudulent charge?

- No, it is a legitimate charge. However, if you see it without making a recent purchase, contact your bank for verification.

How long does BP FDMS CAT stay on my account?

- Typically, it lasts 1-3 business days but can take up to a week depending on bank processing times and gas station policies.

Why is the BP FDMS CAT amount higher than my purchase?

- The hold amount is usually higher to cover potential full-tank purchases. The difference is refunded once the transaction is finalized.

Can I dispute a BP FDMS CAT charge?

- Yes, if you believe the charge is incorrect or unauthorized, contact your bank to initiate a dispute with supporting details.

How do I avoid BP FDMS CAT charges?

- Pay inside the station instead of at the pump or use a credit card without pre-authorization holds to avoid these charges.

Why is there a hold on my account after getting gas?

- The hold ensures that you have sufficient funds to cover a potential full tank purchase. It’s a common practice for gas stations, and the amount will be adjusted once the transaction is complete.

What does it mean if I see multiple charges for the same transaction?

- It could be due to the pre-authorization hold and the actual charge being listed separately. The hold should drop off within a few days, leaving only the final purchase amount.

Can pre-authorization holds impact my credit score?

- No, pre-authorization holds do not impact your credit score as they are not considered actual debt. They simply reduce your available balance temporarily.

What should I do if I notice a hold that I don’t recognize?

- Verify your recent purchases to ensure it’s legitimate. If the hold seems unfamiliar, contact your bank to investigate and potentially dispute the charge.