Why PAI ISO Charges Appear and How to Handle Them

Introduction to PAI ISO

PAI ISO, known as Payment Alliance International Independent Sales Organization, often appears on bank statements, causing confusion. Founded in 2005, Payment Alliance International (PAI) manages over 75,000 ATMs across the U.S. Understanding PAI ISO charges is essential for managing your finances effectively. These charges typically appear for ATM withdrawals or merchant transactions processed by PAI.

Why PAI ISO Appears on Your Bank Statement

Common Scenarios for PAI ISO Charges

PAI ISO charges commonly occur during out-of-network ATM withdrawals. Using ATMs outside your bank’s network often incurs higher fees. Additionally, PAI ISO charges appear when completing transactions at merchants using PAI’s processing services.

Understanding the Nature of These Fees

PAI ISO fees help cover the costs associated with processing transactions and maintaining payment systems. These fees vary depending on the bank’s policies and the specifics of the transaction.

Decoding PAI ISO Charges

Typical Descriptions on Bank Statements

PAI ISO charges may appear under various descriptions, such as “PAI ISO ATM Withdrawal” or “Payment Alliance International”. These descriptions help identify the source of the fee.

Variations by Bank and Region

The exact wording of PAI ISO charges can vary depending on your bank and location. It’s important to familiarize yourself with how these charges appear on your statement.

Impact of PAI ISO Charges

Cost Implications for Users

PAI ISO charges typically range from $2 to $5 per transaction. Frequent use of out-of-network ATMs can lead to significant fees over time.

Frequency and Amount of Charges

The frequency and amount of PAI ISO charges depend on your transaction habits. Regular use of PAI-operated ATMs or services will result in more frequent charges.

Also read: WUVISAAFT Charge Explained

How to Identify PAI ISO Charges

Steps to Verify Charges

To identify PAI ISO charges, review recent transactions for any ATM withdrawals or merchant purchases processed by PAI.

Contacting Your Bank for Clarification

For more details, contact your bank or PAI’s customer service. They can provide specific information about the charges and help clarify any uncertainties.

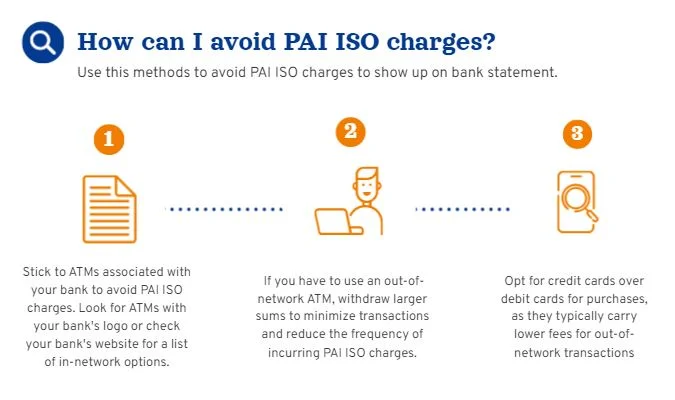

How to Avoid PAI ISO Charge

Alternative Payment Methods

To avoid PAI ISO fees, use ATMs affiliated with your bank. This reduces or eliminates out-of-network fees.

Best Practices for Minimizing Fees

- Use Bank ATMs: Always choose ATMs within your bank’s network.

- Plan Withdrawals: Withdraw larger amounts less frequently to minimize the number of transactions.

Managing PAI ISO Charges

Monitoring Your Spending

Regularly monitor your bank statements to track PAI ISO charges. This helps you stay on top of your spending and avoid unnecessary fees.

Using Financial Management Tools

Utilize online banking tools and financial apps to get real-time alerts on transactions. This helps you keep track of any PAI ISO charges immediately.

What to Do If You Don’t Recognize a PAI ISO Charge

Steps to Verify and Report Unauthorized Charges

If you find an unfamiliar PAI ISO charge, verify it against your transaction records. Contact your bank to report any unauthorized charges.

Fraud Prevention Tips

Regularly check your bank statements and use secure ATMs to prevent fraudulent charges. Be cautious with your card details to avoid unauthorized transactions.

The Role of PAI ISO in Financial Transactions

PAI ISO plays a crucial role in financial transactions, acting as an intermediary between ATMs, card networks, and banks. This helps ensure smooth processing of transactions, whether for cash withdrawals or merchant payments. Understanding this role can help users grasp why these charges appear.

How PAI ISO Helps Prevent Fraud

PAI ISO collaborates with law enforcement to prevent ATM fraud. They use advanced security measures and real-time reporting to detect and prevent unauthorized transactions. This collaboration helps protect users from potential financial losses due to fraudulent activities.

Common Mistakes Leading to PAI ISO Charges

One common mistake that leads to PAI ISO charges is using out-of-network ATMs without realizing the associated fees. Another mistake is not monitoring bank statements regularly, which can result in unnoticed and accumulated charges. Awareness of these mistakes can help avoid unnecessary fees.

Benefits of Regularly Monitoring PAI ISO Charges

Regularly monitoring your bank statements for PAI ISO charges can help you catch unauthorized transactions early. This practice also helps you understand your spending habits and identify areas where you might reduce fees by changing your transaction methods.

Future Trends in PAI ISO and Digital Payments

The landscape of financial transactions is constantly evolving, with digital payments becoming more prevalent. Future trends may see changes in PAI ISO charges as new payment technologies and regulations emerge. Staying updated on these trends can help you manage your finances more effectively.

Frequently Asked Questions About PAI ISO

Are PAI ISO Charges Refundable?

Typically, PAI ISO charges are non-refundable. However, if an error occurs, contacting your bank may help resolve the issue.

How to Dispute PAI ISO Charges

If you believe a PAI ISO charge is incorrect, initiate a dispute with your bank. They will investigate and may reverse the charge if it is unauthorized.

Common Misconceptions

Many people confuse legitimate PAI ISO charges with fraudulent ones. Understanding the nature of these fees helps in identifying legitimate transactions.

Read to know about Tiktok Shadow Bans

Conclusion

Understanding PAI ISO charges is crucial for effective financial management. By familiarizing yourself with the reasons behind these fees and knowing how to manage them, you can avoid unnecessary charges and maintain better control over your financial activities. Regularly monitoring your account statements and being proactive in addressing any discrepancies can help ensure you’re not paying more than necessary for your transactions. By following the tips outlined in this article, you can manage PAI ISO charges more effectively and safeguard your finances.

Understanding the detailed breakdown, impact, and methods to avoid or manage PAI ISO charges can empower you to handle your financial transactions more effectively. Always stay proactive in monitoring your bank statements and be ready to act if you spot any irregularities.